Credit Card Payments for Rent Growth Rate Estimates

- Steady Year-over-Year Increases

Various property management software companies and real estate analysts have reported an increase in digital rent payments (including credit card usage) in the range of 10% to 20% year-over-year over the past several years. This figure largely reflects a migration away from paper checks and cash toward online platforms, spurred by convenience and flexible payment schedules. - Acceleration During the Pandemic

Between 2020 and 2021, online rent payments, including credit card transactions, experienced significantly higher adoption rates due to social distancing measures. Some platforms recorded adoption growth as high as 30% during this period. - Long-Term Trend

Current projections suggest that the number of renters paying by credit card or digital methods could rise by 5-10 percentage points within the next two to three years, aligning with the overall consumer shift toward digital financial solutions.

Sources: Federal Reserve Bank of Philadelphia Consumer Finance Institute

Should You Pay Rent with a Credit Card?

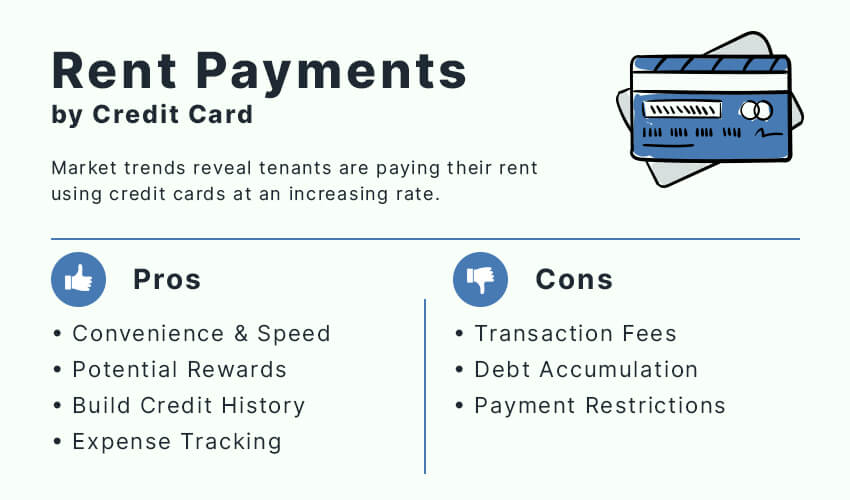

Paying rent with a credit card is an appealing option for many tenants, especially as credit cards become standard for everyday expenses. This trend is gaining momentum among tenants who value convenience, potential rewards, and the option of a temporary financial buffer for monthly obligations.

Many landlords are flexible with the payment methods they accept for rent, recognizing that accommodating tenant preferences can foster higher satisfaction with their tenants and reduce turnover.

For many renters, the prospect of earning airline miles or cash-back points on what is typically their largest monthly expense is compelling. Others appreciate the assurance that a delayed paycheck will not automatically result in missed payments. At the same time, concerns arise regarding additional fees, the risk of accumulating debt, and whether approaching rent as a credit card purchase is advisable in the long run.

Trending Payments by Credit Card

Rent Payment Trends

Rent payments made via credit card have become increasingly common, reflecting broader shifts in consumer habits. While many property managers once found credit card usage to be a niche preference, recent data shows steady growth in adoption rates across various rental markets. This indicates a gradual move away from traditional payment methods, like paper checks and money orders, toward more streamlined, digital solutions.

Several factors contribute to this upward trajectory. First, online payment portals have simplified the transaction process, allowing tenants to manage rent from their smartphones or computers. Second, many renters view credit cards as a convenient financial tool, especially for large, recurring bills. Finally, ongoing changes in consumer behavior, such as favoring speed and ease of use, reinforce the popularity of credit cards for monthly rent.

Demographics

Demographics also play a critical role in shaping payment preferences. Younger renters, particularly those who grew up in the digital age, are often drawn to the convenience of credit cards and online transactions.

They may also appreciate the added benefits, such as earning rewards or building credit history. Meanwhile, older renters, who might be more accustomed to checks or bank transfers, are increasingly adopting digital solutions, although they may still weigh factors like processing fees and security concerns before making the switch.

Reasons for Choosing Credit Card Payments Over Other Methods

- Convenience and Speed

Credit card rent payments eliminate the need for paper checks, postage, or in-person drop-offs. Many platforms support autopay, ensuring tenants never miss a due date. - Potential Rewards

Cash back, travel miles, or loyalty points can be compelling incentives for tenants who already rely on credit cards for everyday spending. These perks effectively reduce the cost of rent, especially if balances are paid off monthly. - Financial Flexibility

Using a credit card can provide a short-term cushion for tenants facing income variability. If timed properly, it can help bridge the gap until their next paycheck. - Digital Record-Keeping

Credit card statements provide a clear, consolidated record of rent payments, which can be beneficial for personal budgeting and end-of-year tax documentation (if applicable).

Should Tenants Pay Rent with a Credit Card?

Evaluating Personal Financial Situations

- Understand Your Monthly Budget

- If you track expenses and pay off your statement balance before interest accrues, credit-based rent payments can be advantageous.

- If you struggle to clear your balance each month, adding rent could exacerbate financial strain.

- Assess Income Stability

- Individuals with irregular paychecks might value the flexibility of a credit card, as it can bridge temporary cash flow gaps.

- For those with consistent pay, be cautious of interest charges if you do not pay off the full statement balance.

- Consider Credit Score Implications

- Paying rent with a credit card can contribute positively to your credit history if payments are made on time.

- High balances increase your credit utilization ratio, potentially harming your score if not managed carefully.

- Long-Term Goals

- Using a credit card strategically could align with goals like building credit or earning rewards.

- On the other hand, unforeseen expenses can lead to rising interest costs if rent charges carry over multiple billing cycles.

Weighing the Convenience vs. Potential Costs

- Convenience Factors

- Automated payments can eliminate missed due dates and the need for paper checks or in-person drop-offs.

- Some cards offer rewarding benefits such as cash back or travel miles, which may partially offset rent expenses.

- Transaction Fees

- Many payment portals pass processing fees to tenants, reducing the net benefit of any rewards earned.

- Compare these fees against the value of potential perks or the cost of alternative payment methods.

- Risk of High-Interest Debt

- Carrying a large rent balance can accumulate significant interest charges, especially if other expenses also land on the card.

- If you anticipate difficulty paying off your monthly statements, consider a less costly payment method.

- Striking a Balance

- Weigh the pros (convenience and possible rewards) against the cons (fees and interest charges) in the context of your personal finances.

- Ultimately, whether credit card rent payments are right for you depends on your ability to manage the associated costs responsibly.

Pros of Paying Rent with a Credit Card

Potential for Credit Card Rewards

Choosing to pay rent with a credit card can open the door to attractive reward programs. Some cards offer cash back, others grant travel points or airline miles, and a select few even provide exclusive perks like lounge access or concierge services. By funneling a major expense, like paying monthly rent through a rewards card, tenants may effectively lower their overall cost of living, provided they pay off the balance in full. However, it’s crucial to verify that the potential rewards outweigh any processing fees.

Building Credit History

For renters who consistently make on-time payments, using a credit card can strengthen their credit profile over the long run. Timely rent transactions add another layer of positive payment history, illustrating financial responsibility to lenders and credit bureaus. As credit scores improve, individuals may qualify for favorable loan terms, better interest rates on mortgages, or even premium credit cards with more generous perks. The key lies in maintaining disciplined spending habits and ensuring each monthly statement is managed responsibly.

Easier Tracking of Expenses

Paying rent through a credit card creates a clear paper trail, simplifying budgets and financial record keeping. Credit card statements can be accessed online at any time, often organized by category. This can be extremely useful for tenants who are trying to keep a closer watch on where their money goes each month, especially when juggling multiple financial obligations. Having all expenses in one place can help simplify a tenant’s tax preparation, particularly if any portion of the rent is deducted for work-from-home or business-related use.

Cons of Paying Rent with a Credit Card

Transaction or Processing Fees

Paying rent with a credit card often comes with additional transaction or processing fees. These charges can be a percentage of the total rent, sometimes ranging from 2% to 3% or more, which quickly adds up when monthly rent runs into the thousands. Even the most appealing cash back or airline mile programs may not fully offset these extra costs, especially if your rent is already a significant portion of your budget.

For tenants who are focused on maximizing rewards, the key question becomes whether the perks gained are worth the fees incurred. In certain scenarios, card benefits, like a generous signup bonus, might justify the added expense. However, if the monthly processing fee outstrips potential rewards, you may find yourself paying more than you had anticipated.

Risk of Accumulating Debt and Interest

One of the most pressing concerns with credit card rent payments is the risk of falling into debt. Because rent is typically a tenant’s largest expense each month, placing it on a credit card can lead to high balances that become difficult to pay off. Carrying forward these balances incurs interest but can also inflate your credit utilization ratio, potentially harming your credit score over time.

Even disciplined spenders can encounter unexpected financial hurdles such as medical bills, car repairs, or job changes that make it challenging to clear a large credit card balance before interest accrues. Once revolving debt kicks in, the original convenience of credit-based rent payments may feel overshadowed by interest charges. Having a realistic plan to pay the balance in full is crucial for keeping these risks under control.

Landlord/Property Management Restrictions

Although credit card payments are becoming more common, not all landlords or property management companies welcome this option. Some businesses choose to avoid the administrative headaches or fees associated with processing credit card transactions. Others may allow it but impose strict policies or surcharges to cover additional costs they incur.

This inconsistency can create confusion for tenants who prefer a uniform payment experience. Before signing a lease or committing to credit card payments, it’s important to clarify whether they’re accepted and understand any limitations or extra fees involved.

Will You Earn Points for Paying Rent with a Credit Card?

Reward Programs and Eligibility

One of the most alluring aspects of paying rent with a credit card is the prospect of earning points or cash back on an otherwise routine expense.

Whether you’re aiming to rack up airline miles, hotel rewards, or a simple cashback bonus, these programs can appear to offer an attractive incentive. However, not all reward programs view rent payments equally. Some issuers will credit points for a rent transaction just like any other purchase, while others may exclude rent altogether or classify it in a non-reward category.

- Check Your Card Terms

- Before adding your landlord or property management company as a payee, review your card’s rewards structure. You’ll want to confirm whether rent qualifies as an eligible purchase, and if so, at what rate (e.g., 1 point per dollar, 2 points, etc.).

- Before adding your landlord or property management company as a payee, review your card’s rewards structure. You’ll want to confirm whether rent qualifies as an eligible purchase, and if so, at what rate (e.g., 1 point per dollar, 2 points, etc.).

- Third-Party Platforms

- Certain platforms designed for rent payments specifically partner with credit card issuers to ensure smooth processing. These services might have unique agreements or promotional offers that let you earn points more seamlessly.

- Certain platforms designed for rent payments specifically partner with credit card issuers to ensure smooth processing. These services might have unique agreements or promotional offers that let you earn points more seamlessly.

- Promotional Bonuses

- From time to time, credit card companies may run promotions that offer elevated rewards on specific categories. While rent seldom appears as a standalone category, you never know when a limited-time bonus might pop up.

Bonus Category Considerations

Not all spending categories are created equal in the eyes of credit card issuers, and that rings especially true for rent payments. Most credit cards have clearly defined bonus categories such as dining, grocery, gas, and travel. Rent, however, generally falls under a broad category of “miscellaneous” or “personal services,” which rarely earns bonus rates.

Other Factors to Consider

Credit Utilization

Credit utilization, the percentage of your available credit that you’re currently using, plays an essential role in determining your credit score. When you charge a large recurring expense like rent to a credit card, it can quickly drive up your utilization ratio, especially if you keep your credit limit relatively low or you’re juggling multiple bills on the same card.

- Short-Term vs. Long-Term Effects

- A one-time spike in utilization might be manageable if you pay it down immediately, but consistently high balances can erode your credit health over time.

- Credit Limit Adjustments

- Some card issuers allow periodic limit increases; requesting one may help keep your utilization ratio in check, even if you regularly pay rent on your card.

- Monitoring is Key

- Regularly tracking your balance ensures you’re aware of how close you are to your limit and whether it’s time to explore alternative payment methods to avoid a ding in your score.

Payment Platforms and Security

As credit card rent payments gain popularity, countless online platforms have emerged to facilitate the process. While these digital solutions can offer valuable convenience, it’s important to understand their security measures and fee structures:

- Encryption and Data Protection

- Look for platforms that use robust encryption methods (like SSL or TLS) to safeguard your personal and financial information. Reputable providers often display security certifications, which can be a helpful indicator of their commitment to data protection.

- Fraud Prevention

- A reliable payment platform should have additional layers of fraud detection and identity verification. Multi-factor authentication, transaction monitoring, and proactive alerts can all help protect your account from unauthorized activity.

- Platform Fees

- Some platforms will absorb part of the transaction fee or split it with the tenant, while others may pass on the full cost. Understanding how fees are assessed and whether your landlord passes them directly to you can influence whether paying rent by credit card remains cost effective.

Alternatives to Credit Card Payments

Before you commit to monthly credit card rent payments, it’s worth examining other methods that might align better with your financial goals and monthly budget:

- ACH or Direct Debit

- Automatic bank transfers often come with minimal or no fees, making them a solid choice for those who want a “set it and forget it” approach without the added cost of credit card processing.

- Checks

- Though less convenient, paper checks remain a traditional fallback. They can be especially useful if your landlord or management company charges high credit card fees or if you’re striving to keep your utilization ratio low.

- Money Orders or Cashier’s Checks

- For tenants who may not have checking accounts or prefer guaranteed funds, these options provide a secure means of payment. However, they do require additional effort to purchase and present in person or via mail.

- Rent Payment Apps (Non-Credit Card)

- Several mobile apps allow direct transfers from your bank account at minimal cost. While they may not offer rewards, they can save you money on transaction fees and still deliver digital convenience.

Paying rent with a credit card is an option that resonates differently with each tenant. Some may find it invaluable for managing fluctuating income or building their credit history; others may regard it as an unnecessary expense once fees and potential interest charges come into play.

In the end, whether you decide to pay rent with a credit card depends on a careful balance of convenience, cost, and long-term financial strategy. By staying informed and evaluating your personal situation, you can determine the payment method that best serves your goals, both now and in the future.